Australia's Mobile Black Spots

With connectivity issues towering over the nation, mobile infrastructure needs new era

If the growth of the digital economy throughout COVID-19 signals a productive future, then telecommunications infrastructure is Australia's backbone.

But certain fixtures of Australian life make providing equitable access to services across the nation a challenge. As said by Department of Infrastructure, Transport, Regional Development and Communications senior official Andrew Madsen, rural Australians are spread across more than seven million kilometres of land whilst urban populations favour large, detached housing.

This has meant continual re-configuring of how to promote investment in telecommunications infrastructure where it’s not economically viable for telcos.

All the while Australian people, especially those in regional and rural areas, experience connectivity concerns in their daily lives, businesses and disaster responses.

The Mobile Black Spot Program

After the 2013 election, the federal government announced the advent of the Mobile Black Spot Program (MBSP) to help extend mobile phone coverage and industry competition for the provision of coverage in remote, regional and outer metropolitan areas.

Over the six rounds of the program to July 2021, the federal government has committed 380 million dollars to the program.

The program began with 100 million dollars of available funding supplemented by state and territory governments and other organisations to provide a co-investment model with network carriers and operators to build mobile towers at designated sites.

The Department of Communications and the Arts - administering the MBSP - developed a Database of Reported Locations.

Information for proposed sites was collected from public submissions as well as submissions by federal MPs. In its early stages, the database contained about 6000 mobile black spot locations.

The database opened once more for more submissions under Round Four of the MBSP. As it sits today, the available database has more than 13,000 listed mobile black spot sites. Given the government's recognition of about 6000 sites at the time of Round One, stripped back from more than 10,000 entries, it’s likely this data is a representation of all raw submissions.

Nevertheless, using the available data, 73 per cent of the sites are located in inner and outer regional Australia. Remote and very remote locations were almost equally represented in the data, the latter about 12 per cent. While major Australian city locations made up only three per cent of the submissions.

Despite the program being a response to the Abbot government’s promise to extend regional communications, the selection of black spot sites under the first round funding raised immediate concerns.

The Minister for Communications shadow assistant of the time (2015), Michelle Rowland, called for an audit over concerns about lack of transparency about how funding was awarded. The minister said more than 80 per cent of the locations for new mobile phone towers were liberal or national electorates, with less than seven per cent labour electorates.

A comprehensive audit of the program in 2016 found the selection of base stations was aligned with the program’s initiatives. But that the program had several administrative weaknesses which resulted in not properly targeting sites of coverage needs thereby affecting the value of the program.

The audit also found the electoral distribution of selected base stations was primarily driven by the areas that operators chose to locate their proposals.

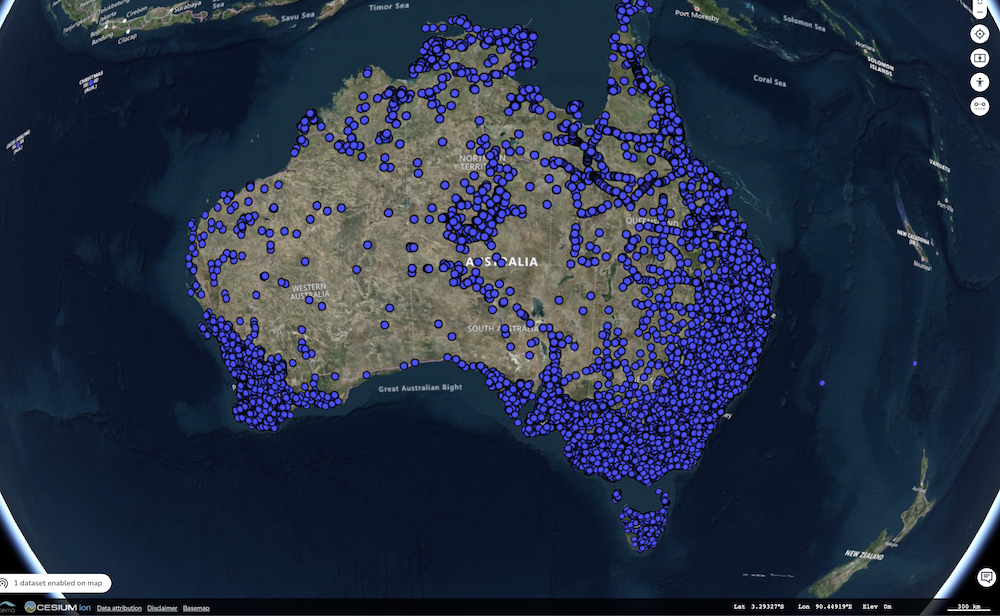

thenationalmap.gov.au mobile black spot locations

thenationalmap.gov.au mobile black spot locations

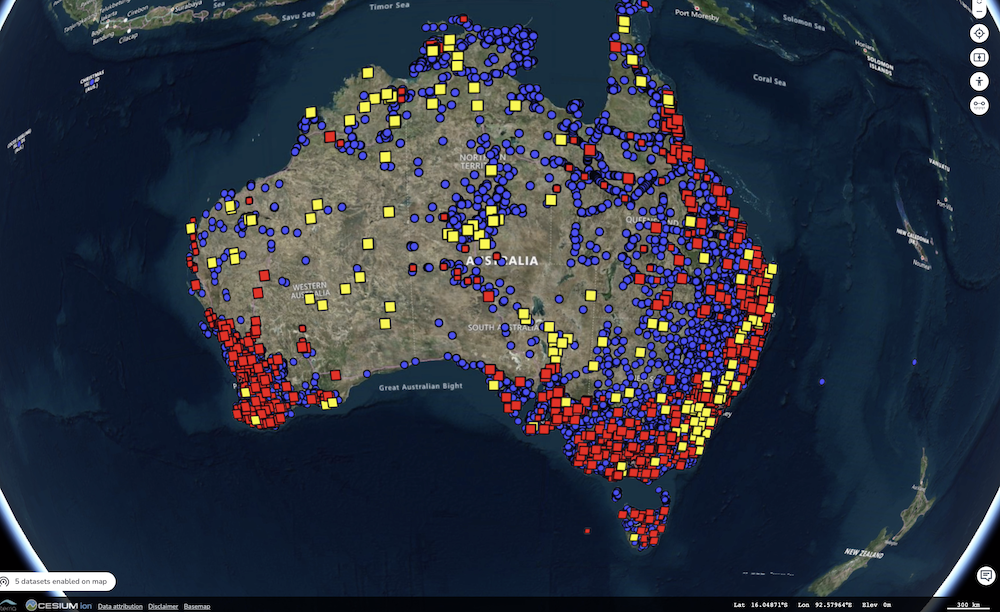

thenationalmap.gov.au funded base stations under the MBSP

thenationalmap.gov.au funded base stations under the MBSP

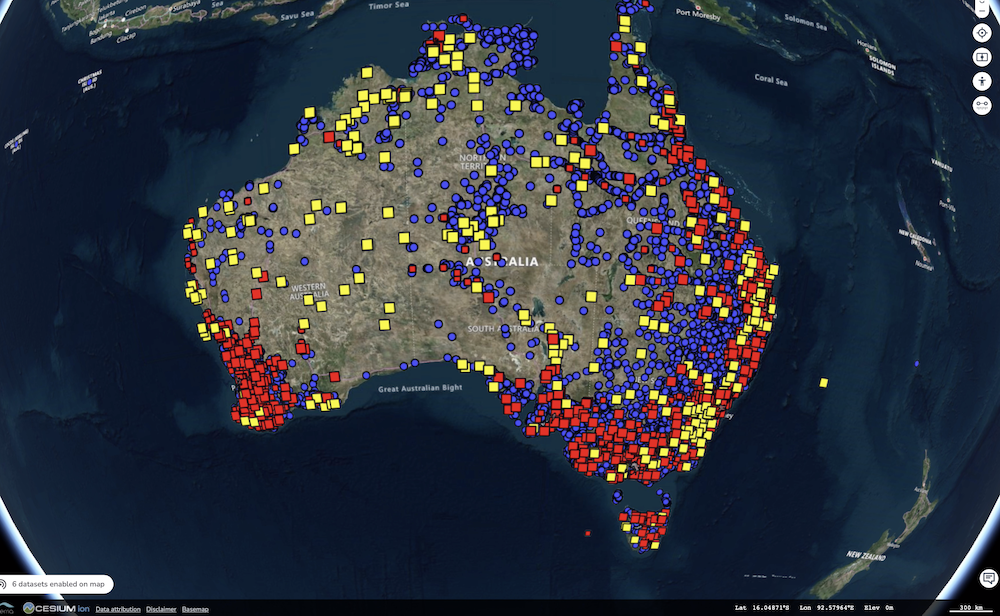

thenationalmap.gov.au funded base stations under the MBSP

thenationalmap.gov.au funded base stations under the MBSP

Coonawarra, SA, by Charles G taken from Unsplash

Coonawarra, SA, by Charles G taken from Unsplash

Operation roll-out

Applications to build base stations under the funding program had to be put forward by national Mobile Network Operators or Mobile Network Infrastructure Providers.

Telstra, Australia’s historically important telecommunications network provider, said on its MBSP FAQ it was required to nominate regional and remote locations from the government’s database of mobile black spots. It said the program’s tenders were an open and competitive process with all carriers having an equal opportunity to put in bids to deliver coverage.

Noticeably missing from the MBSP first round awarded funding for base stations is Optus. The 2016 audit of Round One said Optus was left off the table because its proposals were not recommended for funding following the program’s merit assessment process.

But Optus was awarded 113 sites (112 according to the Optus site) in Round Two, 12 in the Priority Round, 49 in Round Four and 85 in Round Five. This would be what Optus showed on its website as a total (combined under co-investment model) investment of 136.3 million dollars.

Optus also showed on its website, 101 of its Round One sites were live, four from Round Two were live and seven from the Priority Round were live.

Meanwhile, TPG Telecom (formerly Vodaphone) was awarded 70 sites in Round One, four in Round Two and one in the Priority Round.

On the Vodafone website, Vodafone showed it had completed 60 of its sites so far, with 10 base stations not being able to be built because of unforeseen circumstances.

TPG Telecom was absent from Round Four, Round Five and Five A.

Notably, Telstra was awarded the highest number of stations for each round. Telstra said on its website over the first five rounds of the program since 2015, it would have invested up to 300 million dollars of its money to build around 930 sites, more than two thirds of the total 1296 sites co-funded by the federal government.

An interactive map on the Telstra website shows which base stations have been completed and which ones are proposed.

Mobile reception along #ClydeMountain is now improved with a new mobile tower complete, as part of the Mobile Black Spot Program 📱🚗🏖️ There are now 927 towers complete across Australia. pic.twitter.com/ZzA4vAgjxI

— AusGov Media & Tech (@AusGovMediaTech) June 16, 2021

"Coverage and performance...

...are not the same thing"

A September 2021 update to the program issued by the Department of Infrastructure, Transport, Regional Development and Communications (formerly the Department of Communications and the Arts) said the MBSP was delivering improved coverage outcomes and benefits to the Australian community with 961 base stations activated as of 30 September 2021.

The department's statement said base stations funded under the first five rounds of the program are scheduled to be operational by 30 June, 2022.

RMIT University school of engineering associate professor Mark Gregory said while the program delivered key positives of increasing coverage for identified problem areas, coverage and performance were not the same thing.

“There’s no follow up in terms of has the infrastructure been built in a way that it's going to optimise the coverage... is the infrastructure providing the performance that consumers need in that area...” Dr Gregory said.

The program's September update came as the tri-annual Regional Communications Review closed its submissions period. The report would be submitted to the federal government by December this year.

A submission to the review by the The Australian Communications Consumer Action Network (ACCAN) included recommendations for the MBSP.

In its submission, ACCAN said while there had been significant investment in telecommunications infrastructure in recent years through the mobile black spot program, the regional connectivity program and the completion of NBN, gaps in access remained.

The submission recommended funding be made available for a study of regional telecommunications performance.

RMIT University's prof Mark Gregory said in the last few regional telecommunications reviews, a lot of anecdotal evidence was provided through submissions that there’s a problem with regional connectivity performance, whether it be fixed or mobile.

"The performance can be affected by the amount of data that's being provisioned by the carriers. In other words, this isn’t something that's down to an impairment that the carriers can't do anything about. This is something that they can do something about, because it really is just a matter of them provisioning more data at the towers.”

The NFF has outlined recommendations for improving telecommunications and connectivity in the bush in its submission to the Federal Government’s 2021 Regional Telecommunications Review.

— National Farmers' Federation (@NationalFarmers) October 2, 2021

Find out more here:https://t.co/xvLdUtvKN4 pic.twitter.com/gHWUYVKkJE

Image by Mariah Edgoose

Image by Mariah Edgoose

ACCAN’s CEO Teresa Corbin said it was especially concerning to see less telcos applying (for the MBSP) because of how essential telecommunication services had proven to be in emergency situations.

“Mobile network providers have said they’re seeing less commercial return for new mobile towers because the additional towers being built have been constructed in areas with lower populations,” Ms Corbin said.

“Because the Mobile Black Spot Program doesn’t currently incentivise telcos to build and maintain infrastructure in areas where they’re not going to make as much of a profit, we’re seeing telcos become less and less likely to apply for funding.”

Indeed, Round Five of the government’s MBSP made 80 million dollars available and only succeeded in allocating 34 million dollars to build new sites. This pushed leftover funds into another round (Five A) which would focus on different program deliveries.

Field Solutions Holdings (FSG), a non tier-one player in telecommunications infrastructure, was awarded 3.66 million dollars under this sixth round. In a statement, FSG said this was a ten-fold increase from Round Five.

Field Solutions partnered with Optus for Round Five and for 5A will deliver a trial of Neutral Host Radio Access along the Adventure Way in QLD. This involves seven base stations.

ACCAN CEO Teresa Corbin said ACCAN welcomed neutral hosting technology, having advocated for it on behalf of customers.

“A neutral hosting model would ensure that regional Australians have access to fast, reliable, and affordable communications services, no matter which provider they’re with. It would also mean that consumers in the regions could choose their mobile provider, and not just be stuck with the default option. This would increase competition in communities that have traditionally only been serviced by one provider,” Ms Corbin said.

“Telcos would also benefit from a neutral hosting model, as it would reduce costs associated with maintaining towers and facilities in regional or remote areas.”

In an article on the Vodafone website, Vodafone said that the MBSP was “a patchwork of mobile coverage” and a missed opportunity in delivering choice and cost saving via infrastructure sharing.

'I can't see the sense in their reasoning': Questions over Optus contract for remote mobile black spot https://t.co/zivplnzdGQ

— ABC Brisbane (@abcbrisbane) February 10, 2021

Whether the MBSP can deliver on competition, access and performance measures with its seventh round on the way could therefore partially rest on neutral hosting technologies.

But the potential of this program is paramount alongside Australia’s embattlement with fixed-line services and the decommissioning of 3G networks in the years ahead.

By Mariah Edgoose